Psonic products have support for exchange & regulatory-mandated risks, compliance, data storm, and order integrity checks for each trading venue and market. Risk checks can be applied to orders, market data and network events. Psonic products also support the development and implementation of client-specific checks.

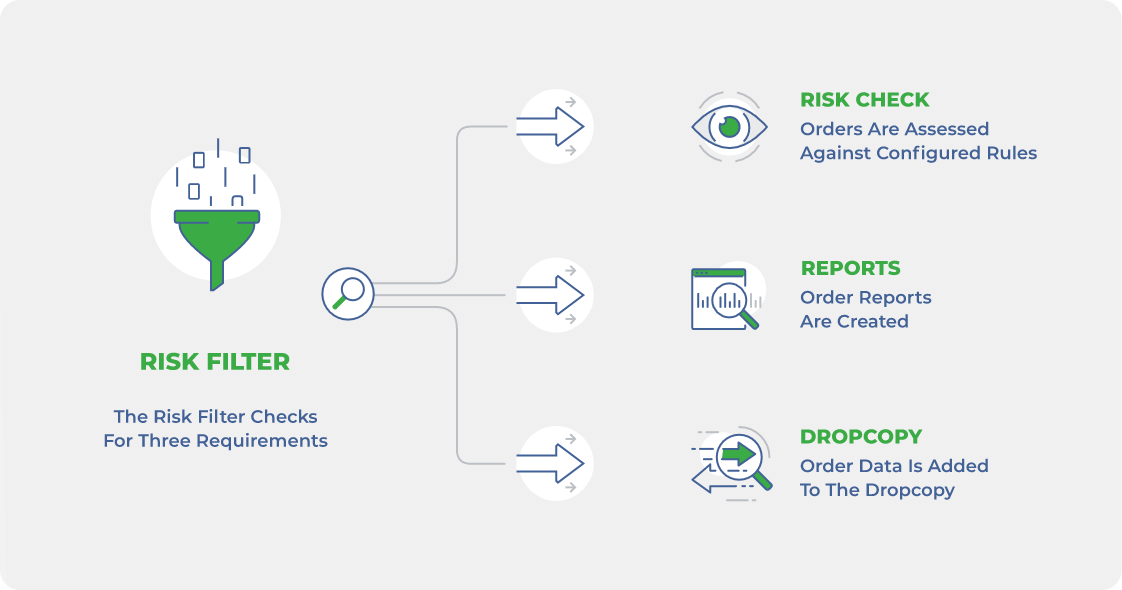

All orders must pass through the applicable checks before they are sent on to the exchange or venue. These risk checks underpin the important Kill-switch / Red button functionality. Typically, checks include:

RISK

- Per order quantity/notional value

- Gross or net value

- Margin

- Storm control

COMPLIANCE

- Restricted instrument

- IPO

- Order size relative to the market, daily volume, or outstanding shares

- Price-based checks

ORDER INTEGRITY

- Lot or tick size

- Message format

- Order/packet rate

- Repeating order

Storm control solutions are designed to identify and restrict data packet storms that can result from badly behaving client trading systems or bank/broker trading algorithms.

With a fixed amount of bandwidth available for trading (particularly with the utilization of hardware in trading platforms), it is important to quickly catch and stop non-nominal situations that could ultimately cause harm to exchanges, banks/brokers, and clients.

Our tools enable the selection of the type of data to monitor and provide configuration of data velocity and the time windows of interest. The tools can provide alerting functions and/or kill capabilities.